Amex Once Per Lifetime Rule How to Get It Again

This post may contain affiliate links; please read our advertiser disclosure for more information.

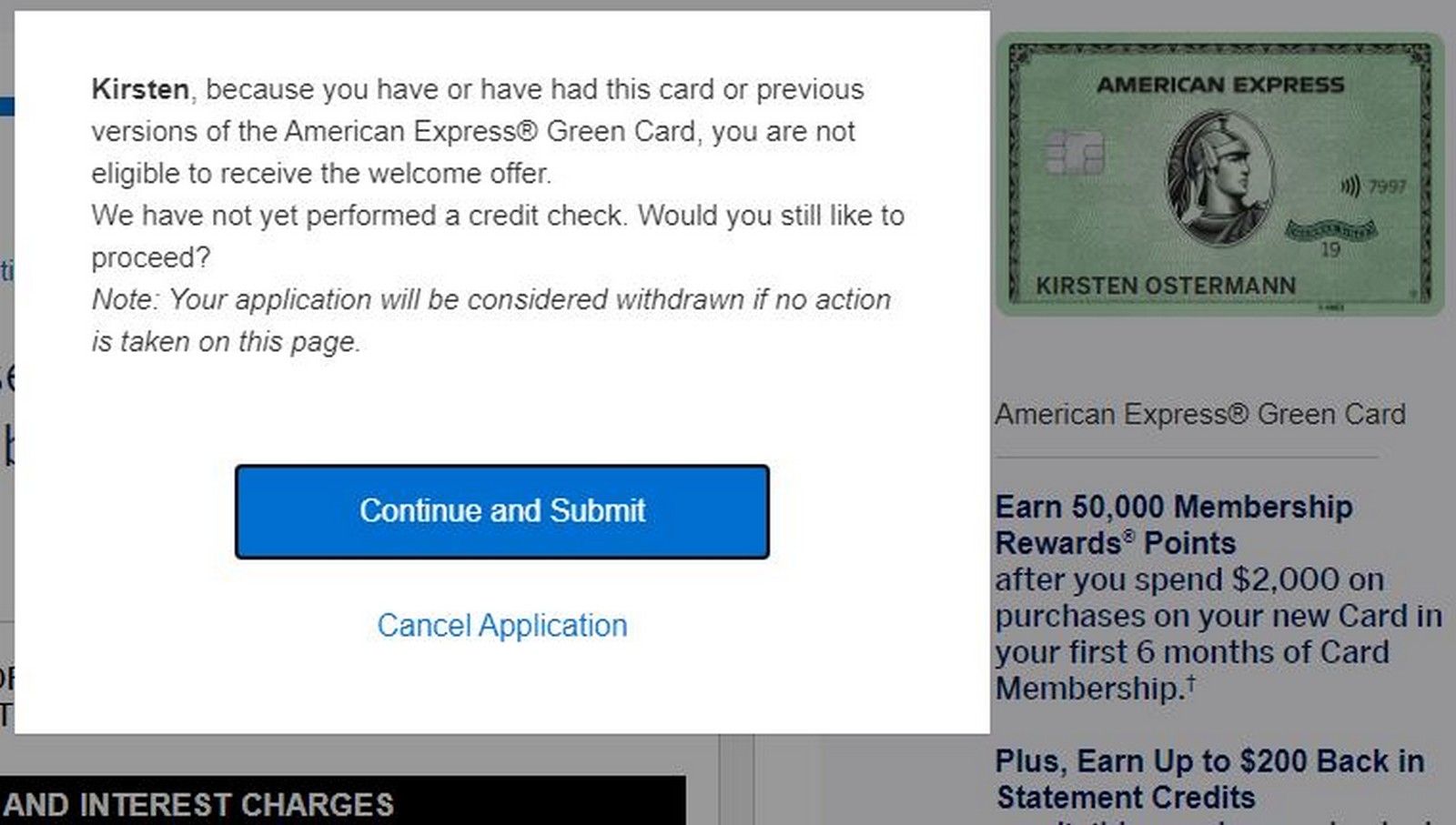

The Amex Once Per Lifetime Rule Snaps Back On My Recent Attempt

A week ago I shared my experience shaving years off of American Express' once per "lifetime" rule. Since the rule launched we have assumed the lifetime parameters really meant 7 years. That was until recently when people started getting canonical at only 5 or vi years since they last carried the card. I tried pushing the envelope and was able to go an Amex Green menu, and the welcome offering, at iv 1/2 years. I decided to push button that a little further still with my wife, and it didn't quite work out.

Update iv/24/21:I recently had my wife endeavor signing up for the Amex Gold Business card via my personal referral. She received the pop up for that every bit well fifty-fifty though it is non a carte du jour she has ever had. I am not sure if the Amex Green awarding put her on the naughty list or if she already was on the listing before applying for the Green carte du jour and that throws all of my "findings" off a flake. I am inclined to believe the Green carte du jour application put her on the popular upwardly listing for all cards considering she had not been very active with Amex merely that is a approximate on my function. It could also be the personal referral that is causing the popular upwards which has been known to happen from time to time. Simply I figured I would update you on what is going on since more data helps u.s. all out.

Background On The American Limited One Per Lifetime Rule

Here is a list of the American Express application rules which you tin can find onour complete bank application rules guide:

- Maximum of 4 credit cards.

- A maximum of 10 cards without a preset limit.

- two cards in a rolling xc day period.

- Welcome offers are in one case per lifetime.

- 7 years is considered a lifetime with American Express. The 7 year clock starts once you lot shut the account. Upgrades and downgrades will count confronting you.

- A popular-up will alert y'all if you are not eligible for a particular welcome offering.

And here is what we accept written on the once per lifetime rule:

The other rule is "once in a lifetime". From Amex's terms on applications, "welcome offer non bachelor to applicants who take or take had this carte du jour". This means that holding the card at whatever betoken is the important part, not receiving a welcome offer for the menu. So upgrading or downgrading to a card you accept never had earlier would eliminate y'all from beingness able to become the welcome offer etc.

There are targeted offers without lifetime language are semi-frequent, and data points besides suggest that "lifetime" is more likely 4-7 years. Considering of this "lifetime" language, holding out for loftier welcome offers is recommended.

My Feel & Theories On Why It Worked

I don't want to go into besides much detail since you can read last week's article. Just I was able to get the Amex Dark-green card and the bonus at only 4 i/two years after closing my account. There were some theories thrown out there on why it worked:

- Amex had an IT overhaul ii years ago that reset the clock for people.

- The newly revamped Green carte du jour was considered a new production and not the same as the onetime Greenish card.

- Maybe the "lifetime" requirement dropped from 7 years to four years.

I decided to test these options out with one application. Remember that this is just i information point and then we can't say anything for sure only I idea it would be interesting nonetheless. And it just so happened to exam all of these parameters, which was kind of perfect.

I also couldn't resist dipping my toe in that referral bonus pool one more time.

My Wife's Recent Experience

My married woman is currently sitting at 4 credit cards with Amex and I am not able to close any of them to costless up space. She just got a retention offer on the Aspire card and her Everyday Preferred (even though I had planned to close it). Her Hilton Business organization menu is less than a yr old and I am non touching her Bluish Concern Plus. So that left me with non credit cards as her only options.

She has already carried the Platinum and Green card, plus she currently has the Gold so I didn't take a ton of options. I didn't desire her to go a business carte since the spend requirements are on the higher cease (she currently has the lower spend Green Business organisation card). That had me checking her Amex Green personal card closure date to see if I could requite that some other run. The 50K offer plus $200 in home improvement credit is a great option. Not to mention the 25K referral I would get as well. So I said allow's do information technology!

Her Application Details

She had last held an Amex Light-green card in January of 2018. That was less that iii 1/two years ago which sounded like the perfect time frame for my experiment.

- It was under the theorized four twelvemonth lifetime clock.

- Information technology was later than the IT change over in Amex'south systems.

- She had the old version of the Green card and non the new version.

This would exam all iii Amex once per lifetime rule theories in one shot, that is what I telephone call perfection. So she filled out her info and striking submit and….

Bam! The Amex Pop Up 😥.

What Does This Mean?

What does this mean? Well nothing really since information technology is just i information signal but I will say I think nosotros can rule a few things out:

- The application terms specify that yous are ineligible if you had this, or any previous version, of the dark-green card. And then I don't think that the newly revamped card being a new product is a feasible explanation.

- The time frame is well past the 2 years ago or then that Amex had their It revamp so I don't think that plays a function really.

- The 4 year limit could be a affair although we have seen data points for less than those.

- I volition say those information points could have been no lifetime language offers.

- And if they were concern cards Amex tends to treat those a trivial differently (i.e. more loosely).

This could be a totally unrelated popular upwardly also for her unabridged account. I won't know that for sure until I try some other application. I would put that at a low take a chance of probability since she has never had it before, hasn't had a lot of applications or closures and spends a ton on her cards.

Amex In one case Per Lifetime Dominion – Final Thoughts

The ane good matter nearly the Amex pop upwardly is that it gives you a chance to cancel the application one time you see information technology. So there isn't a ton of harm in testing the limits. Plus Amex rarely does hard pulls for current members any style.

I think with this experiment I was able to dispel some of the theories out at that place. The iv year theory yet has a niggling scrap of meat on its bones but without more than data points we just don't know for certain. Or it could be that the pop upward decides everything and nosotros volition never know exactly what the criteria is for the Amex in one case per lifetime dominion is. I do look forward to trying to figure it out anyway though 😁.

Source: https://milestomemories.com/amex-once-per-lifetime-rule/

0 Response to "Amex Once Per Lifetime Rule How to Get It Again"

Post a Comment